This article covers changes to health care eligibility and requirements to keep their healthcare for people who get their health care through Apple Health (Medicaid) and the WA Healthplan Finder (Affordable Health Care). The information is from Apple Health (WA State’s Medicaid Program) and WA State Health Care Authority (Department of Health) to provide the most up-to-date information and timelines for families and individuals in Washington State.

Brief Overview:

- Apple Health: You and your family may get your healthcare from one of these providers. If so, you are on Apple Health –

- Amerigroup

- Community Health Plan

- Well Point (United Healthcare Community Plan of Washington)

- Coordinated Care of Washington

- Molina Healthcare of Washington

- Projected timeline of changes for Medicaid and Tax Credits

- Links to support and resources

Some changes will be smaller, and some may drastically affect the way your family accesses coverage and medical care. Some of the changes you may have already started to notice are changes in which providers accept which medical plans and whether specialists accept Apple Health. It can be good practice if you haven’t taken your child to see their doctor or specialist in a while to double check if their coverage is still accepted. Doing this a month or so ahead of time allows Provider One to help with setting up a new doctor. The next sections are dedicated to those bigger changes that Federal Legislation is calling for and how it will affect families and the disability community.

The biggest changes that may affect you and your family:

- Reduced Federal funded Medicaid eligibility for refugee, asylee and determined non-citizen adults, effective Oct. 1, 2026.

- Individuals may be eligible for other programs:

- Apple Health Expansion

- 1332 waiver coverage on the Exchange

- Pregnancy or After-Pregnancy Coverage (There are workgroups and community advocacy from the top down to work on supporting access to care and coverage within our State.)

- Federal Work Requirements: Begins December 31, 2026, for adults 19 – 65 to receive full health care coverage if they do not meet an exemption.

- Coverage depends on working, training, or doing community engagement 80 hours per month.

- Exemptions are:

- Pregnant or receiving Postpartum coverage

- Under the age of 19

- Foster youth and former foster youth under the age of 26

- Tribal members

- Medically frail

- Disabled veterans

- Entitled to Medicare Part A or B

- Parents or caregivers of a dependent child or individual with a disability

- AUD/SUD treatment

- You will need to prove Medicaid eligibility every 6 months instead of every year.

- It is essential to keep track of when those letters arrive and to update your information in Provider One or go to update my coverage at HCA to stay enrolled and keep your and your family’s health care.

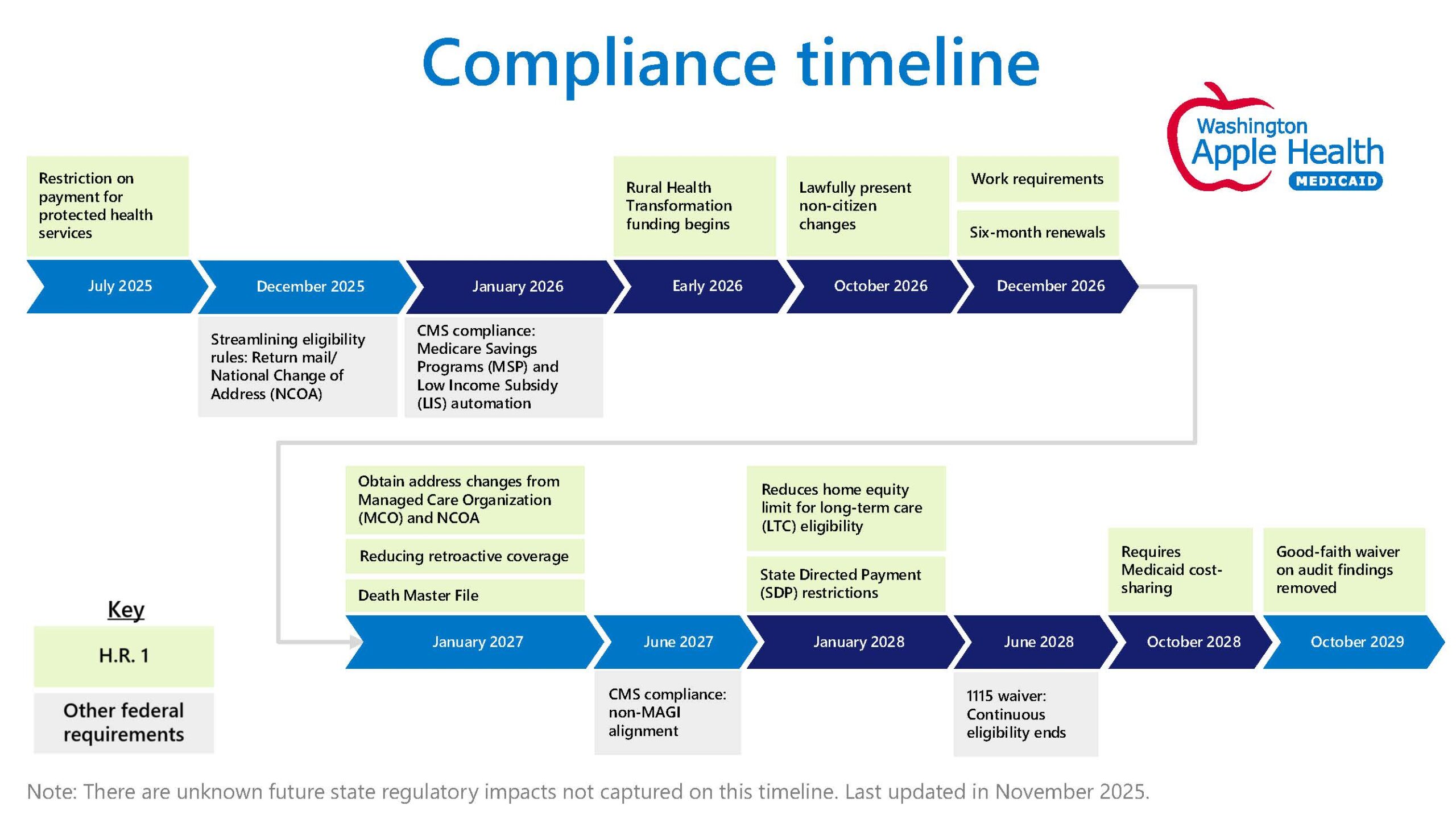

Compliance timeline for regulatory changes affecting health services, with updates through 2029

- Key regulatory changes include a restriction on payment for protected health services starting July 2025 and the initiation of Rural Health Transformation funding in early 2026.

- Streamlining of eligibility rules will occur in December 2025, focusing on return mail and National Change of Address (NCOA) processes.

- Significant compliance updates are scheduled for January 2026, including automation for Medicare Savings Programs (MSP) and Low-Income Subsidy (LIS), as well as changes for lawfully present non-citizens.

- By October 2026, six-month renewals will be implemented, followed by the integration of address changes from Managed Care Organizations (MCO) and NCOA in June 2027.

- State Directed Payment (SDP) restrictions will take effect in January 2028, coinciding with the end of continuous eligibility under the 1115 waiver.

- Future changes include Medicaid cost-sharing requirements in June 2028 and the removal of good-faith waivers on audit findings by October 2028.

- Compliance with non-MAGI alignment is expected by October 2029, alongside other federal requirements such as work requirements, reduced retroactive coverage, and adjustments to home equity limits for long-term care eligibility.

Here is an infographic of the timeline for these changes to help with looking at when things start to take effect:

If you get your health insurance through Washington HealthPlanfinder, a large change has to do with the tax credit and premium increases. The Healthcare Exchange has set up some tools and supports to explain these changes and how the changes will affect the plans. They also have added a way to capture stories about the impacts of the changes if you would like to tell your story.

Here are some links to WA Healthcare Authority and the Healthcare Exchange to ask questions or update your information.

- Apple Health supports

- Washington Healthplan Finder support page

- As information is updated and becomes available it will be posted through PAVE, Family Voices of Washington.

“Congress passed a continuing resolution for the federal budget on July 3, 2025 – This was signed into law by President Trump on July 4. The budget contains numerous provisions that impact Medicaid, food assistance, and the individual market. Hundreds of thousands of Medicaid-eligible residents in Washington will be affected. HCA and state partners are still assessing the full scope of impacts to Apple Health but anticipate significant administrative changes and new state costs associated with implementation.”